Carry Trade

Table of Contents

Introduction

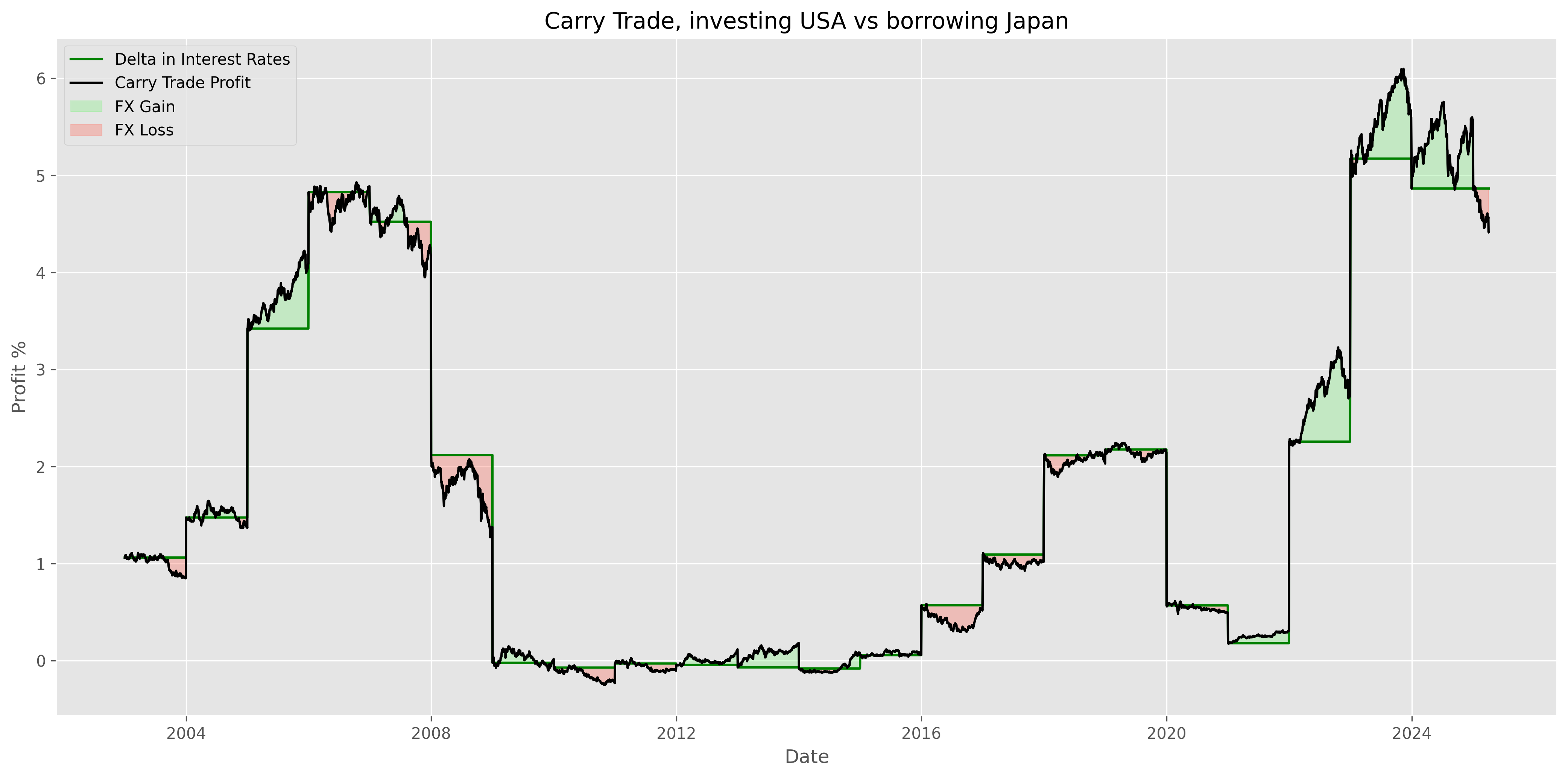

In the last few months and especially at the beginning of august 2024 when the VIX spiked, the Dollar-Yen Carry Trade has been a very important topic in the financial media. More specifically, at the beginning of august the Bank of Japan, in order to fight the depreciation of the Yen, decided to raise interest rates and took them from 0.10% to 0.25%, although it may appear trivial, it made the Yen appreciate significantly against the dollar, mainly due to expectations for further rate hikes.

At that time the Japanese currency was trading around 154 yen to the dollar thanks to the Bank of Japan intervention in the FX market in the previous month; basically the Japanese central bank, in accordance with the FED, entered the market and sold Dollars to buy Yens in order to make the Yen go up in value.

After the rate hike decision by the BOJ the Yen went from 154 to 144 Yen to the dollar and that is significative especially when we consider the fact that usually the exchange rate between major currencies is not very volatile.While the VIX and the Yen were rising, many global investors were caught off guard and that’s the ground where the carry trade partially unwound but what is a carry trade and under what conditions it will likely unwound?

In this paper we are going to discuss about it and we are going to try to understand how complex this investment strategy can get.

The Definition

A carry trade is an investment strategy in which the investor borrows money at a low rate and invests the proceeds in a higher rate of return asset, the difference between these two rates determines the “Carry” which represents the profit for the investor. Although it may appear trivial from a definition stand point, a carry trade can become very complex when there are certain financial instruments involved like derivatives and when multiple currencies and assets are used to diversify the risk.

The Mechanics of a Carry Trade

-

The Currency Carry Trade: in this case the investor borrows in a low interest rate currency and buys a currency that has a higher interest rate. Once he buys the higher interest rate currency he deposits the proceeds in a money market account or in a term deposit account in which he can get the money market rate that is higher than the rate he pays to borrow the other currency.

-

The Asset Carry Trade: this trade is more complex than the previous one because it involves more sophisticated assets and because of that we have different kinds of Asset Carry Trades like:

-

Fixed income Carry Trade in which the asset is either a government bond or a corporate bond. Usually what happens is that government bonds have a lower interest rate than Corporate bonds and that’s mainly because of the lower default risk. This strategy can also involve short term bills, notes and derivatives like CLOs or CDOs.

-

Equity Carry Trade in which the investor uses the proceeds to buy stocks that have a high upside potential from a technical or a fundamental perspective. This type of carry trade can be very risky because of the volatility that the equities can have.

-

Commodity Carry Trade: In this trade, an investor wants to invest in commodities that are expected to appreciate. This type of carry trade is less common but can be lucrative in the right economical and political conditions.

-

Real Estate Carry Trade: in this case the investor wants to use the proceeds to buy foreign real estate, whether it can be commercial or residential real estate.

-

-

The Synthetic Carry Trade: this kind of carry trade is very particular because it involves derivative contracts like FX swaps, currency swaps and FX Forwards. The idea behind this strategy is that the investor wants to get the same exposure to interest rate differentials between the currencies without directly buying foreign currency assets. This type of carry trade, although very flexible because it allows the investor to enter a contract that is tailored to his needs, it has additional costs like derivative premiums, transaction fees and also it introduces a very important kind of risk which is the counterparty risk.

-

The Reverse Carry Trade: this trade is less common but is employed in situations where the investor expects the usual interest rate differentials to reverse or anticipates significant appreciation of the currency in which he has invested.

In this strategy, an investor might borrow in a higher-yielding currency, and invest in lower-yielding assets, betting that the latter currency will appreciate against the one he has borrowed money in. For example, if an investor expects the euro to strengthen due to anticipated monetary tightening by the European Central Bank, he might borrow U.S. dollars at a higher interest rate, convert them into euros, and invest in euro-denominated bonds or other assets. The potential profit comes from the appreciation of the euro, which would allow the investor to repay the dollar-denominated loan with fewer euros.

Risks and Rewards

The Carry Trade’s reward is represented by the spread that the investor gets on the assets he has invested in over the cost of borrowed capital. This return can be significative if he has made the right assumptions and also if he has used leverage to amplify the assumed profit. This investment strategy has some risk and if they are not fully taken into account they can really damage not only the profitability of the trade but also the financial situation of the investors involved. To be more precise, the most important risks involved in a carry trade are:

-

Interest Rate Risk:

This risk involves rate hike decisions of the central bank of the currency in which the investor is borrowing as well as the decisions made by the central bank of the currency in which the investor has invested in. Let’s say, for example, that an investor is borrowing in Yen and the BOJ decides to raise interest rates, then the cost of borrowing increases and that reduces or even eliminates the carry. This is especially risky if the rate hike is unexpected.

Or let’s say that an investor borrowed Yen to invest in US assets, in this case if the Federal Reserve decides to raise interest rates to fight inflationary pressures, that decision can put downward pressure on US assets and that ultimately will reduce the carry that the investor is making.

-

Currency Risk:

This Risk involves movements in the FX market and to be more precise, exchange rates can be influenced by many factors, both political and economical. As an example, sometimes exchange rates are mainly influenced by interest rate differential between currencies and sometimes they are determined by the fiscal and trade situation of a specific country.

What happens is that if the currency in which the investor has invested in depreciates against the one he has borrowed in, the gains from the carry might be wiped out or turned into a loss.

-

Political Risk:

This Risk involves political decisions and the general stability of the government in which the investor has put his money to work. This risk is very important because if not taken into account it could really hurt the investor that could see his investment wiped out.

Let’s say for example that an international investor is borrowing Yen to invest in an oil producing company based in a South American country, in this case if the South American government decides, for whatever reason, to nationalize the oil production to protect its economy from international investors, than in that case the value of the investment made by the international investor goes to zero because he can’t get the profits of that company but the debt has to be repaid regardless of what happened.

Or, let’s say that an investor has borrowed money to buy a foreign asset like a house, a bond or any other financial instrument, if an international institution recognizes the country of the investor as hostile, then it will impose sanctions on that country and if the investor is recognized as a key person for that government, then he could see his foreign assets frozen or even confiscated.

These political decisions can also have a meaningful impact on the exchange rates market because usually when a country is attacked with sanctions, its currency is going to depreciate because investors expect that its economy will slow down and that could put downward pressure on the carry that the investor is making.

-

Liquidity Risk:

This risk is very important because it takes into account the differences between the asset in which the investor can invest in. More specifically, what happens is that in times of financial stress or market downturns, liquidity can dry up and that makes it difficult for investors to exit their positions or to roll over their positions, especially if we are talking about assets that are not listed.

-

Recession Risk:

This risk involves the economical situation of the country that the investor has put his money in. More specifically if a recession occurs or the markets, based on the data, are pricing in one, we can expect a general price decline of the assets of that country and that’s partially what happened at the beginning of August when we got a lower than expected job report and markets started to price in the possibility of a recession and asset prices went down dramatically.

The Strategy

As we have discussed earlier, the carry trade can take many forms and now we are going to analyze a possible investment strategy in which the investor wants to use the borrowed funds to build a portfolio of foreign assets composed by stocks, bonds and residential real estate.

In this particular case the investor could be a bank, a Hedge Fund or any financial institution that expects a currency to depreciate and so it will borrow in that currency and also wants to invest in a world diversified portfolio and so we included markets like Australia, Austria, Belgium, Canada, Germany, France, Italy, United States and many more. The important variables for the portfolio:

As far as the borrowing rate we see that it can be influenced by several factors like:

-

Interest rate decisions: obviously if the central bank raises rates the debt becomes more expensive to repay and the opposite is true. As we all know, monetary policy decisions can be determined by multiple factors like the inflation rate, the unemployment rate but also the financial state of the economy and that ultimately could make it easier or harder for the central bank to act.

-

Exchange rate: Even if the interest rate that the investor pays remains the same, if the currency in which he borrowed appreciates, the debt becomes more expensive to repay, in real terms and the opposite is true. As we all know, exchange rates can move for different reasons, both political and economic but regardless, their movements need to be watched very closely.

As far as the stock market, we see that the more important variables to take into account are:

-

Interest rates: because stock prices, at least from a fundamental perspective, represent the present value of the cashflow that the stock can generate.

-

Economic data: in a Good News = Good news narrative, good economic data is bullish for stocks because investors expect the companies to generate more revenue and therefore more profits.

-

Geopolitical decisions: because stock prices can be influenced by decisions regarding taxes, regulations but also external events like an escalation in a world conflict that can impact the supply of oil, for example.

-

The Narrative: sometimes, strangely as it sounds, stock prices can be influenced by the narrative that is spreading. For example, when the AI mania boomed, all chip factories' stock went up because investors expected higher future earnings. Narrative can also be a powerful weapon to the downside because it can change the impact of a monetary policy decision in the markets; as an example, usually when the central bank lowers rates, stocks go up, but if markets see the central bank’s move as an attempt to avoid a recession, stocks will go down.

As far as the bond market we see that it is influenced by:

-

Interest rates decisions: Bonds are sensitive to the interbank interest rate which is influenced by the FED.

-

Economic data: Bond prices are also influenced by the economic data that comes out and the narrative that it brings, for example, as more positive data comes out, markets can expect the central bank to have a less dovish stance and that ultimately means higher rate for longer which pushes the price of the bond down and its yield up.

-

Supply and Demand dynamics: here we are talking about every factor, both political and economical, that can impact the demand or the supply of this particular bond. For example, a new rule that forces banks to hold more treasuries in their balance sheet as HQLA, a massive issuance of T bills from the US government, or a run for safety in a global financial crisis that would drive the demand for safe haven assets like the US treasuries up.

As far as the real estate market, we see that the main factors involved are:

-

Interest rates: The higher the borrowing rate, the more difficult it is for people to afford a house, and that would ultimately drive the demand down, putting downward pressure on prices.

-

Lending standards: Lending standards are the ultimate factor that determines if a person is going to get the loan to buy the house, and obviously the tighter they get, the more difficult it becomes for people to buy a house.

-

Supply and demand dynamics: here we are including all the other factors that can influence the supply and the demand for houses.